June was an interesting month as markets are again worried about future interest rates and questions about market valuations has been seen in news. S&P 500 index made a new all-time high, markets are generally showing the increased flow of money pressuring prices higher. This is good for many people as they feel richer. New market highs are not that interesting for me, instead it limits my opportunities to find good companies at attractive or so-and-so prices. I do prefer to pay a reasonable price for a good company than a huge premium which will take a lifetime to get back.

My portfolio and general market

My stock portfolio (only stocks) has a value of 52 521,62€ or $55 106,92 while my mutual funds have a value of 347,84€ or $411,75 and ETFs are valued at 1 836,79€ or $2 174,27. Total value of my investment portfolio is then 54 706,25€ or $57 692,94. Not a long way to my short-term goal in market value, yet dividends are behind schedule. This is not a full dividend portfolio as it combines index funds and mutual funds representing around 0,6% of total portfolio. My portfolio five largest holdings are (1 July 2021);

- Telia Company 8,84%

- Nordea 8,38%

- Basf 6,78%

- 3M 6,46%

- Kraft Heinz 6,38%

Of the top five holdings Telia and Kraft Heinz market value is still below acquisition price, even though Telia has reduced the gap significantly compared to beginning of 2021. As you can see the top five holdings represent 36,84% of my total portfolio which some would say is a badly diversified portfolio. As you might know, my goal is not to diversify, but to choose good companies that will return a decent profit in the long run.

There is still a long way to my 2061 goal of a million-euro portfolio and dividends of 55 000 euro. As markets move higher, I usually get less encouraged to invest, this has bothered me, but worked well to reduce any major losses.

Talks about inflation and economic data from U.S.A. as well as minor inflation in Europe might be a sign of interest rates rising in the future. This would move money from stocks to bonds as investors need compensation for bearing the extra stock risk. I would like to see interest rates rise, as we might see some small turmoil in markets which is equivalent to opportunities. What the outcome will be and will we ever see interest rates of 5% in the future is more speculation.

Portfolio Changes

No special changes made to my investment portfolio during June, as you can see below AT&T is again one company, I have increased my position in. Made net investments of 259,89€ in June (net of net dividends) as I have difficulties finding good companies at bargain or so-and-so prices. Hopefully the prices will come down at some point. I you look at my portfolio you will see some holding with a negative return now. I will not buy them as I see they could come down a bit more and some might actually have bought limit orders open as I am writing this post.

AT&T (ticker: T)

Increased my position in AT&T with 14 shares at a total cost of 341,13€ or $408,54. Weighted average purchase price for AT&T position as a result decreased from $31,10 to $30,87.

I know many are criticizing AT&T for the coming dividend cut. For me it does not have a significant impact as most likely I will still get over 3,5% dividend yield and have shares in WarnerMedia. Hopefully WarnerMedia will pay a dividend compensating for the difference to current AT&T dividend.

Apparently I have bought 37 shares in AT&T since start of 2021 for $1 083,99 or $29,30 per share. AT&T has paid me dividends of 63,88€ during 2021 which will drop once they cut their dividend in half. I hope the new combined WarnerMedia and Discovery (Warner Bros Discovery) will start paying a dividend in 2022. Discovery has apparently not paid dividend to common stockholders for a while, which does annoy me as I like companies that can generate some cash flow to owners.

Dividends

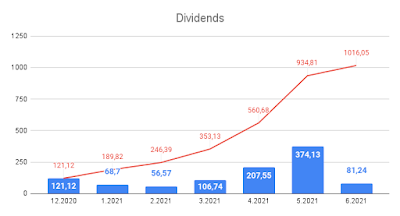

Gross dividends in June were 97,44€ and net of tax 81,24€. Compared to earlier months it is in the same range as February and March while May was exceptionally good due to annual dividends from European stocks. One factor impacting June dividends is that some companies who usually paid in June have now paid the dividend in July (or at least booked in July to my account). The impact is small however still the development would look better given they would have been booked in June.

The below graph displays dividend development since December 2020. During 2021 I have received 894,93€ in net dividends. Which is far away from my goal of 2 200€ at a market valuation of 55 000€, my portfolio value is close to the target while dividends are falling behind. One big question is when will banks be able to open their dividend flow to owners, if it will start in September then my dividends this year might come close to the target of 2 200€. Nordea has only paid a fraction of planned and Wells-Fargo still paid only $0,10 while they back in May 2020 paid $0,51 which would be a big increase to current low level.

Enjoy the summer and will try to have my first company analysis done by end of July.

No comments:

Post a Comment