In September the market did move up and down as if there is a storm coming and some analyst, influencers and other do think so. They might be right, and they might be wrong, it might be the coming interest rate increases or it might have been Chinese Evergrande crisis causing the fear to rise once more.

If we look at stock market history, we see a lot of fears and "happy joy joy" moments, some crashes and fast rises. This is normal and nothing to be afraid of, that is my opinion, I sleep like a kitten during turbulent times and dream of buying even more shares as the market crash. That's just me.

The drop in value did create opportunities for me to increase my positions in companies mentioned below. I did invest more than the two scenarios I created to see if possible to reach the goal of 1 million euro portfolio (link to post here), the yield will be the challenging part, however we shall see what the outcome will be.

Veolia has a rights issue ongoing to purchase the remaining 70% of Suez in which I will participate, yet only 2 shares will be bought (short post about the acquisition).

The graph below displays portfolio development to long-term goal of 100 000 euro, still a way to go as the market value on September 30 was 55 584,23 euro. During September my portfolio fell below the short-term goal of 55 000 euro market value, yet increased above mainly due to my additional purchases. I did want to buy even more shares in all the below companies and some other yet run out of cash. Will have to wait for the coming dividends as well as next paycheck.

Portfolio Changes September

Alibaba (ticker BABA)

Increased my position by 2 shares at $148,90 as the market value dropped, weighted average purchase price decreased from $212,98 to $205,61. I still find Alibaba a good investment in the long run even thought I have heard some negative comments about Alibaba mainly relating to it being under Chinese regulation. The important question to me is, will Alibaba still exist 20 years from now and will they have grown even more and profitable? My opinion is yes, the political risk will not ruin Alibaba so I will hold my position.

Bayer AG (ticker BAYN)

Increased by 1 share to a total of 38 shares, weighted average purchase price decreased from 61,12€ to 60,76€. Still buying Bayer even if some might have lost hope with all the problems they manage to run into. Bayer has good products that help people and do see a future with Bayer still as a significant player with proper dividends and good growth.

Telia (ticker TELIA1)

Bought 30 shares in Telia in the price range of 3,53€ to 3,61€, weighted average purchase price did not move and remained the same at 3,77€ a share. Telias dividend is expected to be paid in beginning of November, will be 1 330 SEK gross and around 1 130,50 SEK net of withholding tax, around 111€. A good contribution and improved reinvestment opportunities.

Telias stock has taken a beating for some years, corruption scandals have hurt Telias reputation. The divestments made might have a positive impact and hope Telias current management is able to improve their reputation and get it on a small growth path.

Dividends

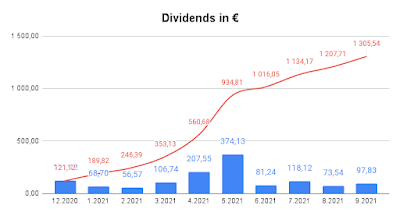

Received a total of 97,83€ in dividends during September, a little more than in June. my position in Pfizer received a full dividend for all 12 share and Wells-Fargo increases their dividend from $0,10 to $0,20. As the graph below displays the biggest dividend months have been April and May, when European companies pay their annual dividends.

In October there will be a small dividend party as Nordea pays a dividend for 2019 and 2020 as well as Old Republics on-time cash dividend.

Below graph shows the monthly net dividends as well as cumulative net dividends, year to date I have received 1 184,42 euro which is 54% of my short-term goal. The gap will be reduced a bit however not enough to reach the full short-term goal, hopefully next year.

No comments:

Post a Comment