August was an interesting month, my portfolio value was stable above 55 000 euros which is good from my goal perspective. The increased positions in Bayer AG contributed with better margin to the short-term goal. If markets start to panic then my portfolio will fall below the 55 000 euro threshold, yet in the long run it does not matter that much.

Focus has lately been to summarize annual reports and find new value opportunities. It has been hard to find value as many companies are valued at high multiples, meaning a long payback period.

I mentioned in my last portfolio update from July that I might consider liquidating some positions. I am still weighting the benefits and costs from having these positions and if some would be liquidated and funds used to increase other positions. The issue I am facing is when to sell and at what price, probably one of the most difficult questions ever in investing. For example, if I would have had some GameStop shares when the stock started to fly I would have exited it way below its high at $483, most likely bought around $2 and sold at $10.

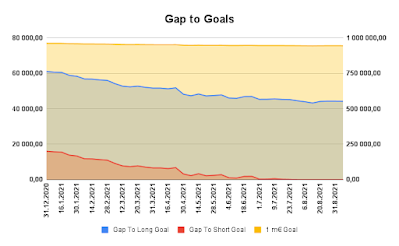

Graph below displays gap to goals in portfolio value. Left axis is for short and long-term goal while right axis is to the ultimate 1-million-euro goal. As you can see the gap to short-term goal is zero.

Markets were behaving interestingly in August, Corona cases, interest rates, employment numbers and inflation pressure has caused some headaches to many. Especially inflation pressure has been a hot topic for a while, and I do see prices rising. Question is then, will prices rise and keep on rising to a extent that forces Central Banks to raise interest rates? It might happen, especially in the USA however Euro area seem to be struggling in different ways that might postpone rate hikes.Portfolio Changes

Small changes during August as still awaiting better moments to increase my positions in a few companies. Was also a bit short on cash at hand which limited the possibility to buy more stocks. In total I purchased shares for 285,64€ in August which is a small amount.

Alibaba (ticker BABA)

Weighted average purchase price decreased from $216,68 to $212,98 as one share was bought for $159,50, not the best price in August but of value for me. Alibaba has been hit by a lot of challenges, Chinese government, sexual scandal and challenges with US Securities and Exchange Commission. As I have been increasing my position it might be a clear statement that I still believe the value of Alibaba to increase over time. I do see more value in Alibaba then many hype stocks as they have more tangible services and products and are not dependent on hypothetical future development.

Bayer (ticker BAYN)

Bought 3 shares of Bayer AG during August, main reason is that I still expect its future to be brighter than what we currently see. As the legal claims regarding Roundup! and Monsanto acquisition will dissappere the future of Bayer will be brighter and earnings stronger. The weighted average purchase price decreased from 62,14€ to 61,12€ per share. Still a way to go when market closed at 47,20€ on Friday September 3rd. If I would have a average price around 50€ per share I would be happy so will most likely continue to buy more.

Dividends

In August I received 73,54€ in net dividends and on a year-to-date basis 1 086,59€ in net dividends. Still far from 2 200€ which is my short-term goal, as the portfolio is being built up on a long-term basis (including taking advantage of any short-term bargains) it might be that the dividend goal will not be reached next year.

The graph below displays monthly dividends (blue staples) and cumulative dividends from start (red line).

Regarding the dividends, note that AT&T dividend does not reflect the full position of 121 shares as 5 shares were acquired after ex-dividend date. AT&T has also the split of WarnerMedia to come which based on statements will reduce the dividend by around 50%. This will have a negative impact on dividends unless Warner Bros Discovery can compensate. Do see it a bit challenged as Discovery has not paid any dividends on common stock for some time.

No comments:

Post a Comment