March was a quiet month investment wise, dividends came in yet a little less then I hoped to receive. Portfolio value increased compared to February from 44 006,45€ to 48 372,79€, or in returns from 4,78% to 12,25%. Did increase a few positions and one new position came in March. Full portfolio and dividends can be accessed via Portfolio page.

Dividends

Received 106,74€ in dividends of which 6 Pfizer shares were acquired after ex-dividend date and therefore Pfizer's full distribution for all 12 shares will come in June. Nordea paid a dividend for 2019 result of 0,07€ a share according to ECBs recommendations. Still hoping for a second payment from Nordea this year, most likely in end of Summer or during early Autum. No major surprises in company payments, stable and that is how we like it. Below is a table showing each payee amount and we can see that 3M, Kraft Heinz and Nordea were the largest payees in euro amount.

Changes in Portfolio

Handelsbanken Latin Amerika

Increased Handelsbanken Latin Amerika with 15€, from 30€ to 45€, the average price decreased a bit yet not significantly. As before stated, once the Corona caused issues are resolved in Latin America I do expect the countries to recover and fast. Tourists will again flow to these counties and support local economies driving a even faster growth. This will support the local companies and markets, increasing the value of companies to a more reasonable level, yet there is the exchange rate risk which might reduce the total gain in the funds currency EUR.

AT&T (T)

Bought 1 share increasing the position from 94 to 95 shares and the weighted average price paid decreased by $0,02. As the price of AT&T has increased my will to continue buying AT&T at the same paste has reduced as it is closing into the price paid so far for the company. I do see AT&T as a good company and apparently the CEO has stated that cash flow is good and used to reduce the amount of debt on balance sheet. Find it positive that a CEO talks about cash flow instead of only earnings per share. HBO is also coming with new series this year which might support AT&T in the long run.

AT&Ts annual report came out in end of February, revenues decreased a bit to about same level as 2018, expenses increased and 2020 they made a loss of $0,75 per share compared to $1,89 in 2019.

Revenue decreased basically cross all operating segments, yet biggest percentage decreases in WarnerMedia (-13,7%) and Latin America (-17,9%). In operating contribution Latin America caused a loss as they have 2019 and 2018. In Q4 2020 AT&T made a write off of its video business, $15 508 (million). The write down is a positive sign where balance sheet is not overvalued (done in accordance with accounting standards).

Balance sheet, current ratio shown 0,82 2020 vs 0,79 2019 a small improvement which is positive, note that AT&T allocated dividends payable as a current liability. Equity ratio of 30,7% excluding non-controlling interest. Treasury stock increased by 36,9% meaning AT&T has used the low market price to buy own stock (this is positive as you do not want management to use the cash when stock is valued at high multiples).

Without the write down AT&T would have made a proper result and as we look at the cash flow statement, we see that 2020 operating activities contributed with the same cash flow as in 2018, about $5 billion less than 2019. Operating cash flow was $43 130 vs $48 668 2019 and $43 602 2018. Investing cash flow was -13 548 driven by capital expenditures just as in 2019 and 2018, however about 4 billion less in 2020. Financing cash flow was negative 32 007 mainly driven by repayment of loans (repayments were bigger then new issues which is good to reduce amount of debt). Issuance of preferred stock had a positive impact on financing cash flow of almost $4 billion. in total cash flow during 2020 was a bit negative and therefore the total cash and cash equivalents decreased by $2 billion (approximately) to $9 870 from $12 295 in 2019.

Canadian Utilities (CU)

Increased by 1 share to 53 and the weighted average price paid decreased by CAD 0,03, still seeing the Canadian company as a good long-term investment.

The 2020 annual report and financial statements are out, and the earnings decreased from 3,24 per share to 1,32. Difference coming from less revenue -17% as well as no gain from sale during 2020 compared to 2019 when they received 174m CAD. Interest expense decreased by almost 18%.

Operating cash flow increased by 20% while investing cash flow was more negative as no sale of operations was made -905mCAD 2020 vs -172mCAD 2019 (923mCAD came in 2019 from sales of operations and ASCHOR).

Financing cash flow was -924mCAD 2020 vs -788mCAD 2019, biggest differences came from issuance of long-term debt which was much smaller in 2020 then 2019 as well as repayment of long term debt decreased 2020 vs 2019. Dividends increased a bit as well as purchase of class A stock.

In total Canadian Utilities cash position changed by -198mCAD before currency translation (combining all cash and cash equivalent accounts to CAD).

Equity ratio is 32,6% (excluding non-controlling interest), current ratio 1,82 (very strong) and current assets consist to 50% of cash which is good in terms of paying off debt and dividends. During 2021 Canadian Utilities has 166mCAD of long-term debt to pay off which can easily be covered by the current cash position while still paying dividends as long as customers pay their bills.

Sampo (SAMPO)

Increased position by 3 shares to 60 in total, the price increased by 0,07€/ share to 35,32€, still I find Sampo a good long-term investment based on the float insurance companies have. Float refers to payments in advance to invest and get a return as claims can only be made after the insurance contract has started (note that people who claim all the time pay usually much more and insurance companies has the option not to insure a person if he or she is deemed too risky).

2020 was not a great year for Sampo if we look at the income statement, profit decreased from 1 237m€ to 112m€, a drop of 90,9%, EPS was 0,07€ 2020 vs 2,04€ 2019. What was dragging down Sampo's result? Main driver was Nordea (-899m€ in impairment and -262m€ from loss upon distribution of Nordea shares as dividend) and costs associated with acquisition of Hastings Group (owns 70% of the British insurance company).

Equity ratio is 20% 2020 vs 22,9% 2019, equity ratio dropped partially due to the extra distribution of Nordea share.

Alibaba Group Holding ADS (new position, ticker BABA)

Bought one share for $228,10 (the one ADS share represents 8 shares, based on 2020 EPS the P/E-ratio is 28,87)

Why did I buy Alibaba?

My opinion is that Alibaba Group is a proper company hit by uncertainty from Chinese Government and SEC demanding regulatory reports from companies listed at US stock exchanges. If the ADS would be delisted, then there will be some legal issues if the investment is lost or not?

I find the stock partially hit by the risk of delisting in US due to regulatory requirements which explains a lower than real market value. Also the Chinese Government has put pressure on Alibaba to reduce their dominant position in China. These two factors have a great impact on the stock price as there is much uncertainty, compared to Amazon and Google where we see much less regulatory risk (except for fines from time to time).

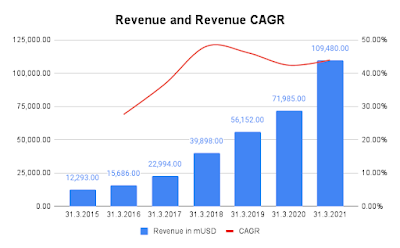

Financials, for the year ended 31 March 2020 Alibaba Group made $7,90 per share (GAAP reported EPS) and they had a net margin of 27,5% ($7,90 per ADS share). The picture below is taken from Alibaba's 2020 annual report showing the revenue development, revenue has grown very fast and most likely the growth rate will decrease over time. If the revenue growth rate decreases (which I expect due to limited market size on this planet and oppositions from regulators if you are too big) then it will not be a big problem as the company shows very profitable business with a huge net profit margin. In the 2020 annual report the company displays a healthy profit since 2016 while having a solid equity ratio of 57,5% in 2020. Interesting is how fast Alibaba's cloud computing segment is growing compared to core commerce segment, personally I see a lot of potential in could business and data management in the future to support businesses even though the segment was loss making in 2020 as core commerce segment was keeping up the total result.

Swinging stocks and market speculation

ViacomCBS has seen its market value move significantly on a year-to-date view. Why has it moved so much and is there any reason to be afraid of losing the investment?

In less than one month ViacomCBS stock has gone from a high of $101,97 to current $44,64, a 56% drop from its high. From its high 22nd March it dropped to the current level due to a margin call on and hedge fund.

the hedge fund causing this drop is Archegos. Archegos is/ was a fund run by Bill Hwang, in last days it has been highlighted as the reason for why a few companie's stocks have dropped heavily and one of the stocks was ViacomCBS in my portfolio. Bill Hwang became known after Tiger Asia Management scandal were he plead guilty to wire fraud and settled some civil lawsuits. Now he was back with a hedge fund and managed to leverage up on a few stocks so much that he blew up AGAIN! I hope nobody will give him any assets or cash in the future to manage as he seems to be better at burning cash then making it. The bet was done via swaps, meaning he did not have to pay the full price of the stock but rather a fraction. The issue was that the contracts were settled daily, if the stock falls Hwang had to pay the bank and if it rose the bank would pay him. Poor timing as Viacom informed of additional stock issue and debt issue. According to Bloomberg Hwang had done the same swap contracts with several Wall Street investment banks without them knowing to which extent his total position was (only knowing the positions he had with them, called poor risk management yet most likely within self-regulated standards).

Let us look at ViacomCBS numbers from last 10-Q filing, diluted EPS 2020 of $3,92 vs $5,36 2019 while profit margins still on and proper level. Based on the $3,92 profit ViacomCBS is trading at a P/E-ratio of 11,39 while the S&P 500 is trading at a Shiller PE ratio of 36,16 (April 1th 2021).

Balance sheet current ratio of 1,66 2020 vs 1,31 2019. Equity ratio excluding non-controlling interest was 29% 2020 vs 26,6% 2019.

Operating cash flow improved 2020 to 2 215million USD vs 1 230mUSD 2019 while decreased compared to 2018 when operating cash flow was 3 464 mUSD. investing cash flow improved mainly driven by smaller acquisition costs. financing cash flow was a bit negative -90mUSD vs - 1216mUSD 2019 and -2 531mUSD 2018. The main difference in financing cash flow is issuance of debt of 4 375mUSD in 2020 while 2019 only 492mUSD was issued and non 2018. The issuance of debt 2020 seems to be partially due to repayment of long-term debt during the year of 2 901mUSD.

As a final note, I do not see any reason for large market value swings driven by financials. Apparently, Mr Hwang was gambling on expectations and the earlier wallstreetbets investors to join the rally and profit from it. Not so professional from and so-called professional investor.

No comments:

Post a Comment