During October we have seen a substantial amount of companies report their Q3 earning, some have reported record profits while other have disappointed all expectations. A normal quarterly flow of reports, some good, some bad and others do not move the markets. As stocks have their own rhythm there are new investment channels such as crypto currencies, NFTs (non-fungible token) and most likely something I haven't even heard about yet. The new channels have taken people with storm, increasing in value beyond my understanding.

As my portfolio swing month to month it is interesting to follow-up which are the biggest holdings based on market value.

Currently my largest portfolio holdings are

- Nordea Bank 9,03%

- Telia Company 8,65%

- GlaxoSmithKline ADR 6,52%

- BASF 6,05%

- 3M Co. 5,72%

The five biggest holdings represent almost 36% of my portfolio while top 10 largest holdings represent over 60% of my portfolio. Many might say it is a risky portfolio and poorly diversified, these people usually interpret volatility as risk while for me volatility is only opportunity. Risk is the probability of losing the investment in any form, meaning either the company files for bankruptcy without any recovery possibilities or the risk that the company loses its competitive edge and therefore sees a significant reduction in its value. There are many other views on risk as many would just use the theoretical systemic and firm specific risk and justify that volatility reflects both.

During October a few minor changes in Top 5 largest holdings was that BASF dropped from 3rd largest holding to forth, overtaken by GlaxoSmithKline. 3M Co rose to fifth place while The Kraft Heinz Company dropped to sixth place. As I have been increasing my position in Telia it has remained one of the largest holdings in market value even as its market value has dropped.

More details and current market value can be found on the Portfolio page.

Portfolio changes

A few changes made during October, as usual just increased positions. Mainly looking at companies that underdelivered to market expectations and are undervalued in cash flow and which most likely could be sold at a premium to current value.

Telia

Bought 110 shares to decrease the purchase price and to increase the coming dividend. Have a total of 1 440 shares now at a weighted average purchase price of 3,75€ compared to 3,77€ before.

Telia announced their Q3 earnings which did not surprise me, yet the market was expecting better results based on reactions.

Kone

Kones share dropped after Q3 publication as investors worried about Chinas impact on future profits. This gave me the opportunity to increase my position to 7 shares at a price of 57,24€, had 3 shares before at 57,25€.

China is a large and important market for Kone, but I expect Kone to adjust fast to market changes and keep their competitive edge to competitors. A quarter here and there has hardly had a long-term impact on a company, except when they have used fraudulent accounting or deceived the public for a long time.

Handelsbanken Latin Amerika mutual fund

Bought 30€ worth in Handelsbanken Latin Amerika fund partially driven by the decreased value, also as my long-term view remains the same. Latin Amerika has not recovered from COVID-19 caused issues and there are signals of unrest in some countries.

Citating Baron Rothschild (not 100% sure he actually said it)

"the time to buy is when there's blood in the streets"

Dividends

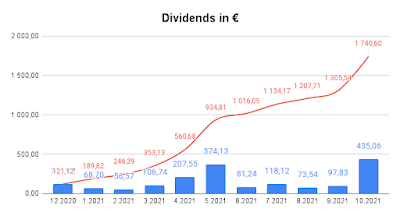

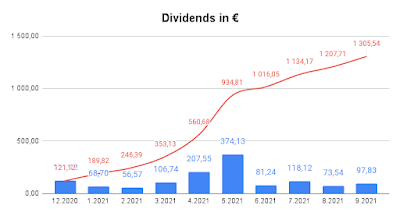

October was a good month as Nordea Bank paid out their dividends for year 2019 and 2020 (note 2019 dividend should have been paid in Spring 2020, yet corona interrupted it). Old Republics extra dividend and GlaxoSmithKlines dividend helped reduce the gap to short-term goal yet not able to achieve it this year.

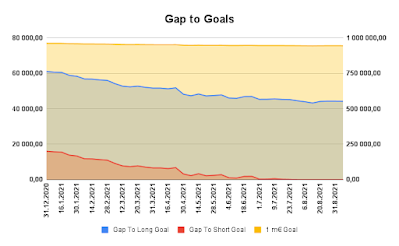

YTD dividends are about 1 600€ which is 600€ from the short-term target. Since December 2020 portfolio has received 1 740€ in dividends and all has been reinvested. The investments made in Bayer AG will hopefully give a return two years from now. Expecting Telia to pay the same dividend of 2 SEK per share next year which will increase my dividends unless SEK falls in value to EUR next year.

Sampo has gathered some funds from the sale of its Nordea Bank shares and they announced at least a dividend of 2€ per share in 2022 which will help narrowing the gap.